Credit card is one of the biggest inventions in this modern retail consumer society and a great advancement in the payment technology of the banking system since the invention of money. A tool that is very essential to the success and existence of any merchant whether it is a internet business , a physical store or both. Most people today carry a credit card for the convenience of not carrying cash, it is less bulky and light while others do so because of the purchasing power they have in their possession which they would not have had otherwise. Credit cards allows anyone to purchase any item that they desire (depending on their credit limit ) that they would not able to afford upfront.

Credit card is one of the biggest inventions in this modern retail consumer society and a great advancement in the payment technology of the banking system since the invention of money. A tool that is very essential to the success and existence of any merchant whether it is a internet business , a physical store or both. Most people today carry a credit card for the convenience of not carrying cash, it is less bulky and light while others do so because of the purchasing power they have in their possession which they would not have had otherwise. Credit cards allows anyone to purchase any item that they desire (depending on their credit limit ) that they would not able to afford upfront.  Credit cards are well engineered for minimum thickness which results in it being light and less bulky, it can easily fit in a wallet (bill fold), purse, pocket or any other personal. It can also easily fit with other similar sized documents such as medical card and drivers license. So, have you ever stopped to think about the evolution of your credit card? I guess you did not. Well this article will explain the evolution of this “cash on plastic” that confidently let you purchase stuff without no money (cash) in your pocket.

Credit cards are well engineered for minimum thickness which results in it being light and less bulky, it can easily fit in a wallet (bill fold), purse, pocket or any other personal. It can also easily fit with other similar sized documents such as medical card and drivers license. So, have you ever stopped to think about the evolution of your credit card? I guess you did not. Well this article will explain the evolution of this “cash on plastic” that confidently let you purchase stuff without no money (cash) in your pocket.In 1914 there was credit system that was used by Western Union to give to their more prominent customers in the interest of good customer service. Prominent (prestigious) customers were given a metal card that was used to defer payments (interest free) on services used by them. This credit system was called “Metal Money”. In 1924 General Petroleum Corporation (an oil company) saw the success and being aware of the value of goodwill this could offer to their customers, also issued their own metal money for gasoline and automotive services. This was first offered to their employees followed by selected customers then the general public after its great success. During the 1920s and 1930s this form of credit card system spread to other companies such as Railroad, hotel chains, airline, oil companies and department stores. In the late 30’s American Telephone and Telegraph (AT&T) introduced their “credit card” called the Bell System Credit Card. The use of such “credit cards” greatly increased after World War II due to the rapid growth of businesses, increase in travel and the great demands for goods and services and thus, it popularity grows significantly.

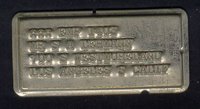

A Sears Store Plate ............... and.............. A Common Store Plate

In 1950, the first universal credit card was introduced by Diners Club, Inc (invented by Diners' Club founder Frank McNamara). This was a new kind of credit card which set the foundation on which today’s card credit is established, unlike the other cards where they could only used for specific goods and services, the Diner Club had a more general use. It was first used by members for restaurant services but quickly expanded beyond that service to cover general travel and entertainment expenses thus covering a variety of establishments. Cardholders were charged an annual fee and billed on a monthly or yearly basis. During the 1950s, because of its convenience and efficiency, its popularity increased and many merchants were very eager to accept the card because customers spend a lot more than if it was cash since they can charge it to their cards.

In 1951 the first bank to implement this credit system was the Franklin National Bank in New York. Customers would submit an application for a loan and were screened for credit. Approved customers were then given a card (Charge-It card) to make retail purchases. This credit card system was similar to today’s system where consumers could made a purchase using the card at participating merchants. This merchant would copy the customers information from the unto a sales slip then obtain authorization from the bank thus, completing the purchase. The bank would then , in turn, reimburse this participating retailer and collect the debt from the consumer at a later date with a flat fee to cover the costs of providing this credit loan. This system was very successful and after a couple of years, other banks impressed with this credit system jumped on board and offered their customers similar services.

In 1958, the American Express Company (a traveler’s check business) entered the credit card business with their version of the universal credit card “Don’t leave home without it”.

Their credit card was used for travel and entertainment purposes and accepted at participating airline merchants, restaurants and hotels. Their credit system policy at the time (which changed in 1987) required cardholders to pay off their balances each month.

In 1959 the Bank of America in California introduced the BankAmericard. They were the first to introduce the revolving credit card. This means customers were now given the option to make a regular monthly payments on the balance owed rather than having to pay off the entire balance at one time. In other words, customers could carry a balance from month to month. Many other banks then followed offering this revolving credit option.

In 1965, Bank of America foresaw more income potential and control and began issuing license agreements to other banks of all sizes in the US. These licensing agreements allowed other banks to issue BankAmerica (Blue, White, and Gold BankAmericard) and also to interchange transactions through these issuing banks.

In 1966 a group of 14 US banks came together to form a new bankcard processing association that provides the ability to exchange information on credit card transactions.

In 1967 a group of four California banks formed a new association entity called Master Charge (renamed MasterCard in 1979) which is now known as MasterCard International. This was done to compete with the BankAmericard (later became Visa in 1977). This new bankcard processing association would expand their services and increase their income potential, thus, these small banks formed a mutual relationships with large national or international banks.

In 1967 a group of four California banks formed a new association entity called Master Charge (renamed MasterCard in 1979) which is now known as MasterCard International. This was done to compete with the BankAmericard (later became Visa in 1977). This new bankcard processing association would expand their services and increase their income potential, thus, these small banks formed a mutual relationships with large national or international banks.In 1969 banks interested in issuing cards of their own, became members of either the Master Charge program (MasterCard Association) or BankAmericard program (Visa Association). This also means that most independent bank charge cards would now change over to either credit card programs. This was mutually beneficial to all banks and small financial institutions since, they shared card program costs. Both organizations issued credit cards through their member banks for their customers. Also, they both lay down standards for credit card processing.

In 1977 BankAmericard spreading its credit card business globally had difficulty achieving this due to the association of "America" in BankAmericard. Thus, its name was changed to Visa. This changing of name was followed shortly (2 years after) by Master Charge to Master Card.

In 1979 Master Charge changed its name to Master Card. Also, the electronic processing of credit cards improved through electronic dial-up terminals and magnetic stripes on the back of credit cards. This allowed consumers credit cards swiped by merchants to accessed issuing bank card holder information. This method decreased fraud, increased speed of processing authorizations and decrease the usage of paper.

In the early 1980s the first Automatic Teller Machines (ATMs) came into existence. This gave credit card holders access to cash in different currencies from different countries around the world as well as locally.

In the early 1980s the first Automatic Teller Machines (ATMs) came into existence. This gave credit card holders access to cash in different currencies from different countries around the world as well as locally.ATMs give consumers the opportunity to have access to cash from their bank account or from their credit card. Also, this gives an extra benefit to card holders since they could make deposits 24 hours a day from most countries around the world.

2005 and beyond: Today, MasterCard, American Express, VISA, and Discovery, are the most popular and also have the most respected symbols when it comes to credit cards.

The credit card/payment system will continue to evolve as a new technology payment system developed through the advancement in science and technology . Read articles below Under the heading :Additional Info. On credit Card- “future credit cards” that are in the making for the near future. Only a few are listed but there are other bigger futuristic developments out there in the making.

Did You Know?

Antitrust Court Ruling:

- Recently (in 2004), a antitrust court ruling was initiated by American Express, Discover and retail giant Walmart against Visa and MasterCard. This court ruling changed the exclusive relationship that Visa and MasterCard have enjoyed with Banks over the years. This allow banks and credit card issuers to provide customers with all credit cards in addition to Visa or MasterCard.

According to CSLF :

- 55% of students obtain their first credit card during their first year of college.

- 33% of students have both student loan and credit card debt after college.

- Discover Card was originally part of the Sears Corporation but then decided to create a new brand with its own merchant network.

Additional Info. On credit Card

Future Credit Cards - New Invention:

Credit Card With Driver’s License - a new type of credit card an all in one.

Credit Card With Digitized Finger Print - credit card containing your finger print in a digitized format to identify you.

Educate Yourself on Credit Cards

Credit Card Basics | Eight Things You Should Know | Who's Looking at Your Credit Report | Facts About Credit Scoring | How many credit cards is too many? | Building a Good Credit History | What is a credit history? | General Information On Credit Card | Preventing Identify Theft |

Wow, that was really informative - I never realized CC's were around for that long!

ReplyDeleteThanks again for your wonderful post.

Thank you for the compliment Furkids. I am glad that you found the post interesting and informative :)

ReplyDeleteTalk to you later.

I remember as a kid, a long time ago, when you used a credit card the cashier had to look up in a little book if the card was stolen or not. Thank goodness that is done electronically now, so much faster.

ReplyDeleteI can’t wait to get rid of the card and just us biometrics. Great post!!

ReplyDeleteBill:

ReplyDeleteThanks to the advancement of science and technology. When you look back from where we are coming from to where we are now, its marvelous.

Thanks also for the visit and comment :)

BlogBank:

You will not have to wait that long. There are so many inventions in the making as we speak.

Thanks for the compliment and for taking the name to leave me a comment.

Later.

really interesting! I will redirect this information to some friends. They will like it too!!

ReplyDeleteThank you and a kiss from Portugal!!

Teresa

Hi found your site very informative,looking forward to future postings.

ReplyDeletenot sure if one reads everything on side bar though

small price to pay on visiting your site

blueman

Teresa:

ReplyDeleteThanks very much for the visit and for that wonderful compliment! : ) I am glad and grateful that you found this post interesting and informative and will recommend your friends to this post!

Please do come again and a return kiss from the US!! :)

Blueman:

Thanks very much for the compliment and the visit. I would be more than grateful to have you as a regular reader.

I had planned to tweak the side bar which I will be doing shortly.

Thanks once again.

'Discovery' card? Thought it was called 'Discover'. Sheesh.

ReplyDeleteI agree, credit card is the greatest invention. Thanks for giving such a comprehensive history

ReplyDeleteoh, wow! what an informative, researched post! i never thought i wanted to know those things, but now that i've read them i'm glad i do!

ReplyDeletewho knew that credit card processing had been around for so long?! 1914!!! Really?!!?

i remember the old metal plates!! the last business i worked at had one for when the terminal failed.

great post!! though i think "credit cards are the greatest invention" may be a very objective statement!

Thanks you. Very good post.Unless they can offer a really compelling reason for users to come back, it will be the next Bebo, MySpace

ReplyDeleteThis Blog is going places, the people, the layout, amazing to see such dedication and focus.

ReplyDeleteCredit cards are definitely useful to those who don't like carrying a lot of cash around. Just like everything else though, use them wisely and in proper regulation.

ReplyDeleteNo one can deny the fact that credit card invention was a wonderful idea. Personally, I don't like carrying my money everywhere I go for safety reason, so I just take my credit card instead. If it gets stolen, I could always have it blocked.

ReplyDeleteI enjoy using credit card because it helps me budget my money when purchasing something. I'm not sure this goes for everyone though because if I'm not mistaken a lot have fallen into the credit card trap. It takes a lot of responsibility to own one, if not you'll end up in debt.

ReplyDeleteTax Defense Network understands that it is difficult for many taxpayers who are in tax debt to repay the full amount of debt in one payment.

ReplyDeletegive taxpayers a break. the economy is bad. http://unn.edu.ng/department/economics

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThis is a beautiful article. Thanks for the great job.

ReplyDeleteUniversity of Nigeria

http://unn.edu.ng

thank you for posting

ReplyDeleteYou can still negotiate with your creditor to lower you outstanding balance

ReplyDeleteKeep it up!! You have done the nice job having provided the latest information.

ReplyDeletewhy is credit important

This blog has very distinct features. Thanks

ReplyDeletefree credit report online instantly

I am informing you all "fabulous information"bubblegum casting

ReplyDeleteThe information you have given in the blog really marvelous and more interesting. www.creditrepair.com

ReplyDeleteI love all details that you give in your articles.

ReplyDeleteclick here for more information

Hi buddies, it is great written piece entirely defined, continue the good work constantly.

ReplyDeleteno medical exam life insurance

These blogs and articles are fully good enough for me.

ReplyDeletecredit repair companies